Auto Insurance in and around Dallas

Dallas's top choice for car insurance

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

Here When The Unexpected Arrives

When it comes to reasonably priced car insurance, you have plenty of choices. Sorting through savings options, coverage options, deductibles… it’s a lot, to say the least.

Dallas's top choice for car insurance

Insurance that won't drive you up a wall

Great Coverage For A Variety Of Vehicles

Terrific insurance as well as multiple savings options are all offered with State Farm. Your coverage can include collision coverage, liability coverage or medical payments coverage, while your savings options can range from the good driver discount, an older vehicle passive restraint safety feature discount or Drive Safe & Save™. State Farm agent Kelsey DeLuca can answer any questions and show you the specific options that may be right for you.

This attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. A policy written with the comprehensive coverage State Farm offers means you can be confident if trouble finds you on the road. Agent Kelsey DeLuca can be there to help you submit your claim. State Farm has you covered.

Have More Questions About Auto Insurance?

Call Kelsey at (214) 295-9717 or visit our FAQ page.

Simple Insights®

What to do after a car accident: A step-by-step guide

What to do after a car accident: A step-by-step guide

In a car crash? Stay calm and follow these simple steps: Check for injuries, call the police, exchange info, document the scene and report to your insurer.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.

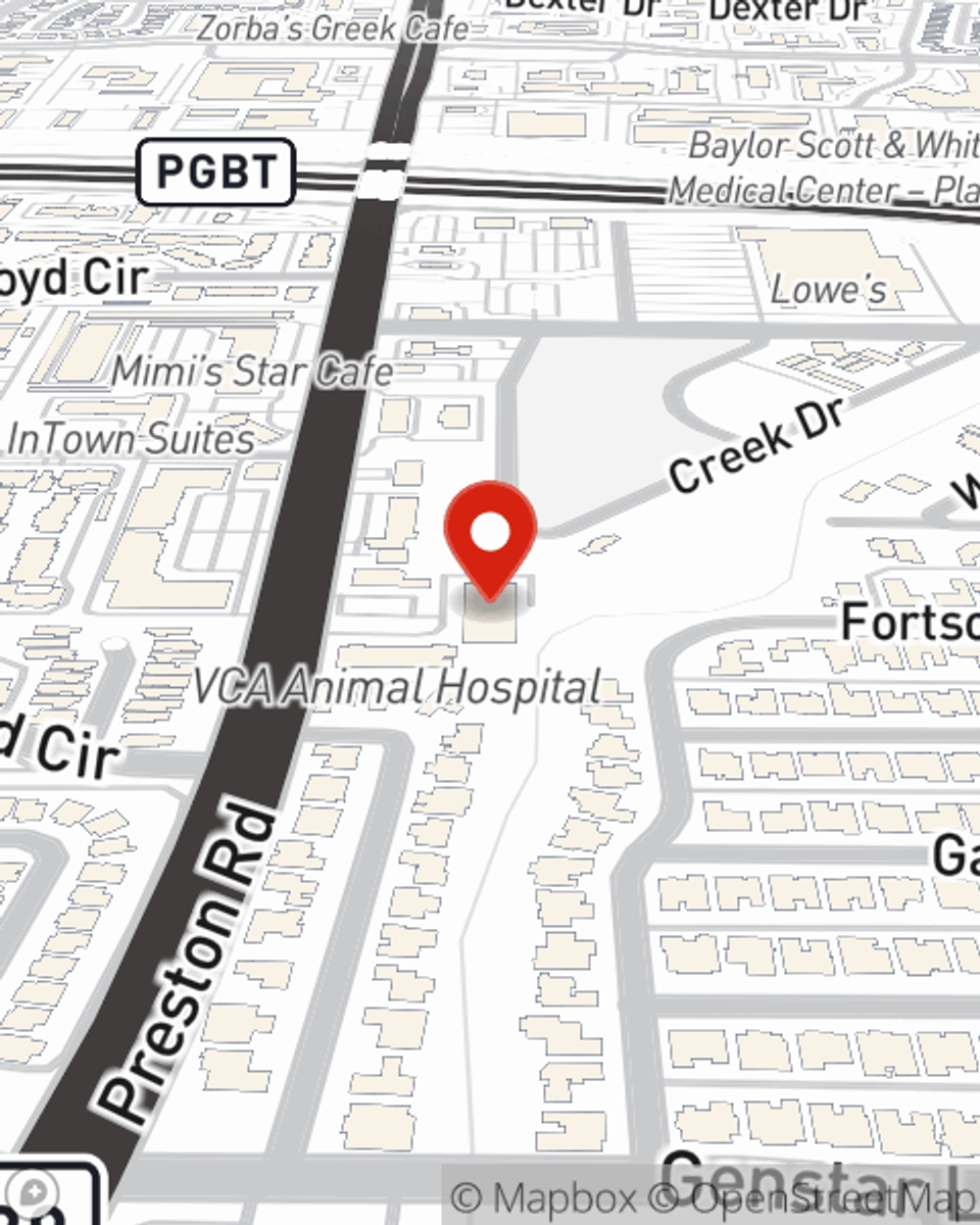

Kelsey DeLuca

State Farm® Insurance AgentSimple Insights®

What to do after a car accident: A step-by-step guide

What to do after a car accident: A step-by-step guide

In a car crash? Stay calm and follow these simple steps: Check for injuries, call the police, exchange info, document the scene and report to your insurer.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.